Tamari attractor

In the mathematics of dynamical systems, the Tamari attractor, named for Ben Tamari, is a 3-dimensional attractor evolving from the dynamic system associated with the theory of a country's economics. This dynamical system is a set of partial differential equations that, by the theory of economics developed by Tamari, control the economics of a country. The main point of this economic theory is that the relation between the quantity of money to the country's output is what governs the country’s economic situation and outcome.

Contents |

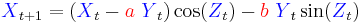

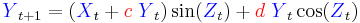

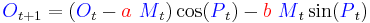

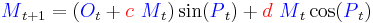

The Tamari equations

The Tamari equations are (blue letters are variables and red are parameters):

Where the parameters in these equations are:

– Inertia

– Inertia

– Productivity

– Productivity

– Printing

– Printing

– Adaptation

– Adaptation

– Exchange rate

– Exchange rate

– Indexation (linking)

– Indexation (linking)

– Expectations

– Expectations

– Unemployment

– Unemployment

– Interest

– Interest

are Gresham coefficients.

are Gresham coefficients.

denotes the country's output (gross domestic product, GDP (

denotes the country's output (gross domestic product, GDP ( ),

),  is the Money axis (the quantity of money, M1 (

is the Money axis (the quantity of money, M1 ( ) and

) and  is the Pricing axis - consumer price index, CPI (

is the Pricing axis - consumer price index, CPI ( ), so the equations may also be written as:

), so the equations may also be written as:

___________________________________________________________

In rates terms: o ( dO/dt) is the growth, m (

dO/dt) is the growth, m ( dM/dt) is the printing, and p (

dM/dt) is the printing, and p ( dP/dt) is the inflation, p = m – o, or as the old saying goes "Inflation occurs when too much money is chasing too few goods".

dP/dt) is the inflation, p = m – o, or as the old saying goes "Inflation occurs when too much money is chasing too few goods".

The first 2 equations are in fact Cremona equations, which Tamari had found suitable to depict the economic situation in the output-money space ( Keynes space [O, M,] ), because of their conservative nature. The third equation is the Feedback equation, which Tamari had developed in a manner of trial and error to fit the statistical data of the countries as found in the “International Financial Statistics" YEARBOOK, The parameters of these equations vary from country to country, according to the statistical data.

Keynes space [O, M,] ), because of their conservative nature. The third equation is the Feedback equation, which Tamari had developed in a manner of trial and error to fit the statistical data of the countries as found in the “International Financial Statistics" YEARBOOK, The parameters of these equations vary from country to country, according to the statistical data.

Economic consequences

Tamari's theory of a country's economic situation says that the situation of the country can be estimated by mapping the country's position on the nest ( Tamari space [O, M, P,]) created by the solutions of the above equations. When the position is within the green boundary of the nest (see picture 1), the situation is stable, and forecasting and planning is possible in the short term. However, if the country's position has moved to the red part (usually after printing too much money due to political chaos, armed conflicts, dictatorships, election campaigns, etc…), the situation is unstable and may lose control.

Tamari space [O, M, P,]) created by the solutions of the above equations. When the position is within the green boundary of the nest (see picture 1), the situation is stable, and forecasting and planning is possible in the short term. However, if the country's position has moved to the red part (usually after printing too much money due to political chaos, armed conflicts, dictatorships, election campaigns, etc…), the situation is unstable and may lose control.

Thus, finding the parameters:  ,

,  ,

,  ,

,  ,

,  ,

,  ,

,  ,

,  ,

,  , by statistical methods (from the statistical data of IMF yearbook), the Tamari attractor may serve to understand, control and predict the economic situation of a country. To show how it is worked, Tamari developed the economic simulator “Eco” (see picture 2).

, by statistical methods (from the statistical data of IMF yearbook), the Tamari attractor may serve to understand, control and predict the economic situation of a country. To show how it is worked, Tamari developed the economic simulator “Eco” (see picture 2).

References

- Ben Tamari (1990) "Ecometry – Foundations of Economics", (Hebrew), Ecometry ltd.

- Ben Tamari (1995) "Dynamic Economy", (Hebrew), Ecometry ltd.

- Ben Tamari (1997) "Conservation and Symmetry Laws and Stabilization Programs in Economics", (Eng.), Ecometry ltd.

- Julien C. Sprott (1993) "Strange Attractors: Creating Patterns in Chaos", M&T Books, NY. ISBN 1-55851-298-5

- International Financial Statistics YEARBOOK 2009, IMF.

- attractors

- Eco - Economic Simulator

![{\color{blue}Z}_{t%2B1} = {\color{red}e} %2B {\color{red}f}\ {\color{blue}Z}_t %2B {\color{red}g}\ \arctan \left [ \frac{(1-{\color{red}u}){\color{blue}Y}_t}{(1-{\color{red}i}){\color{blue}X}_t} \right]](/2012-wikipedia_en_all_nopic_01_2012/I/1aaa146958b06d9ee41469d2c6a3661a.png)

![{\color{blue}P}_{t%2B1} = {\color{red}e} %2B {\color{red}f}\ {\color{blue}P}_t %2B {\color{red}g}\ \arctan \left [ \frac{(1-{\color{red}u}){\color{blue}M}_t}{(1-{\color{red}i}){\color{blue}O}_t} \right]](/2012-wikipedia_en_all_nopic_01_2012/I/3ab93c233d7613460211c9253a2262ae.png)